coinbase pro taxes uk

1 3 minutes read. The Coinbase cryptocurrency platform is getting ready to send over details of some of its United Kingdom-based customers to the Tax Authority in the country.

Coinbase To Launch Advanced Trade As A Replacement For Coinbase Pro

User1 January 13 2022.

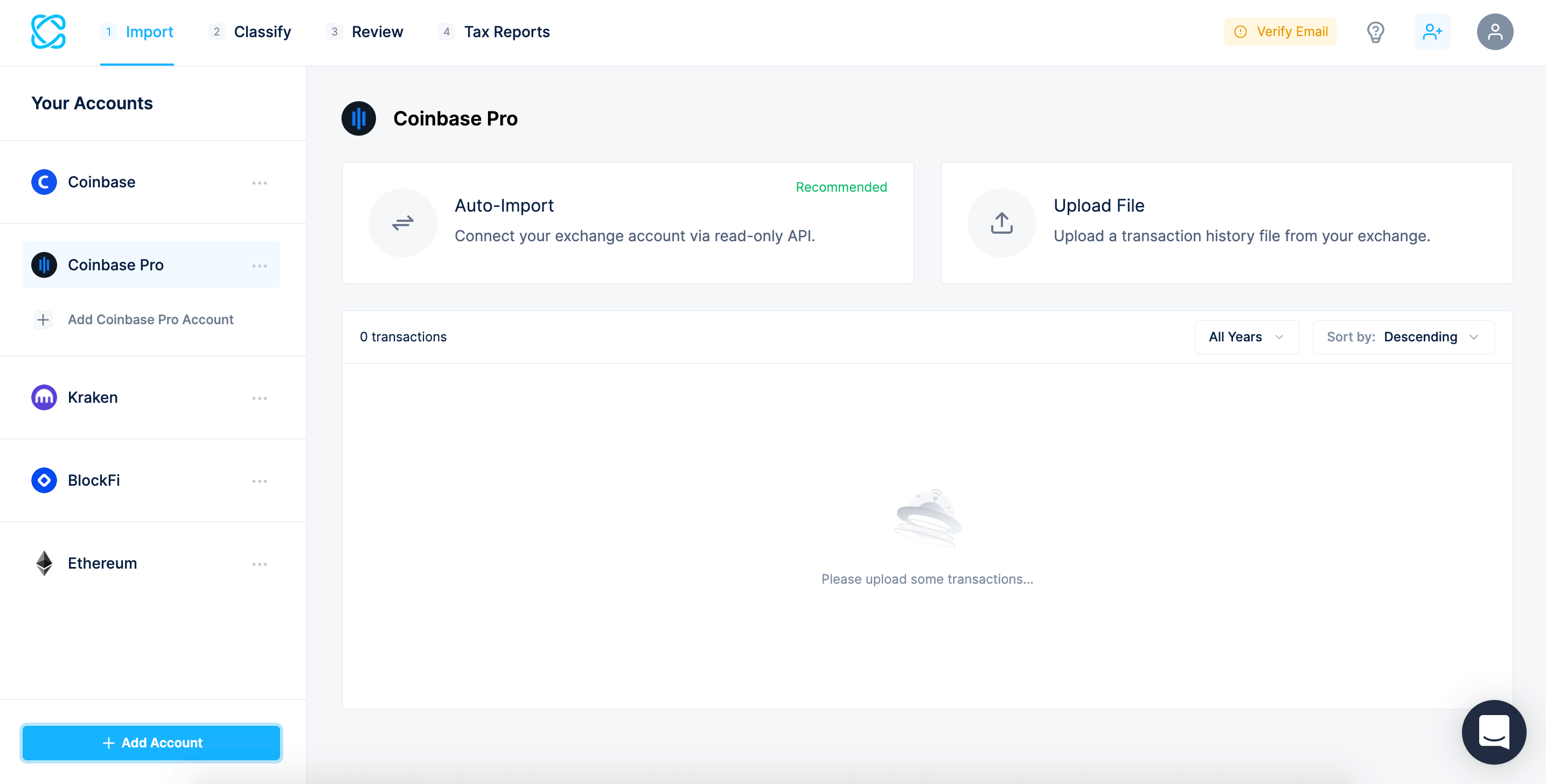

. All you need to do with a crypto tax app is add your Coinbase Pro API keys or upload your Coinbase Pro CSV files and let your crypto tax calculator do the rest. Your guide to cryptocurrency tax terms in the US. Visit Coinbase Pro API page.

Set your start date on or before the date of your first trade. Under Permissions select View. Click New API Key.

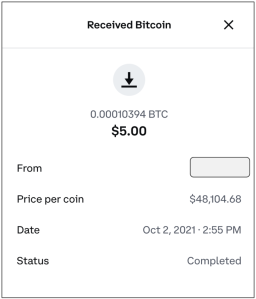

According to the company website you will receive this tax form from Coinbase if. Copy the API Key and paste into CoinTracker. Coinbase Pro tax reporting via API key.

Coinbase Coinbase Pro Tax Reporting Via TurboTax Crypto Exchange Tax Filing Help. Put simply yes. Select All Products in the Product dropdown.

Visit Coinbase Pro statements page. The UK uses a progressive income tax banding - so you wont pay the same flat rate of income on all your earnings instead youll pay a higher rate of tax only on earnings in higher. Select Generate Account.

In many scenarios you can actually use cryptocurrency to minimize your tax burden like by using a strategy known as tax. If this is your first time dealing with crypto as part of your tax returns were here to help. This video will walk you through how to connect your.

Itll calculate your crypto. ⁴Sum of median estimated savings and rewards earned per user in 2021 across multiple Coinbase programs excluding sweepstakes. What About Coinbase Pro Tax Documents.

Connecting your Coinbase Pro account to CoinTracker. You used Coinbase Coinbase Pro or Coinbase Prime in 2020 or beyond. However there might be good news.

Copy the Passphrase and paste into CoinTracker. Just use the Coinbase tax API or a Coinbase transaction history export and upload it to your crypto tax app where it will then generate a custom Coinbase tax form on your behalf. Set your start date on or before the date of your first trade.

AND you earned 600. If you are a Coinbase Pro customer and you meet their thresholds of more than 200 transactions and 20000 in gross proceeds then you. Follow Twitter Follow YouTube Channel.

This amount includes fee waivers from. Select All Accounts set the dates to cover your full account history. Coinbase Pro wont be able to monitor your cost basis and compute your total crypto tax burden if you.

Coinbase Pro for example can only see transactions that take place on their platform. 2021-2022 Crypto Tax Glossary. Select All Products in the Product dropdown.

Cointelli imports your transaction data from Coinbase Pro for easy tax reporting.

The Definitive Guide To Uk Crypto Taxes 2022 Coinledger

7 Best Crypto Tax Software To Calculate Taxes On Crypto Thinkmaverick

Crypto Unicorn Taxbit Joins Forces With Paypal Coinbase Ftx And More To Make Paying Bitcoin And Nft Taxes A Whole Lot Easier

Coinbase Reportedly Warns Some Uk Users It S Handing Their Details To The Taxman Coindesk

Koinly Review Our Thoughts Pros Cons 2022

Coinbase Vs Coinbase Pro What The Difference Crypto Pro

Koinly Vs Coinledger Io Ex Cryptotrader Tax Which Tax Calculator Is Better Captainaltcoin

Uk Cryptocurrency Tax Guide Cointracker

Why Is My Transaction Pending Coinbase Help

Coinbase Review 2022 Pros Cons And How It Compares Nerdwallet

Uk Cryptocurrency Tax Guide Cointracker

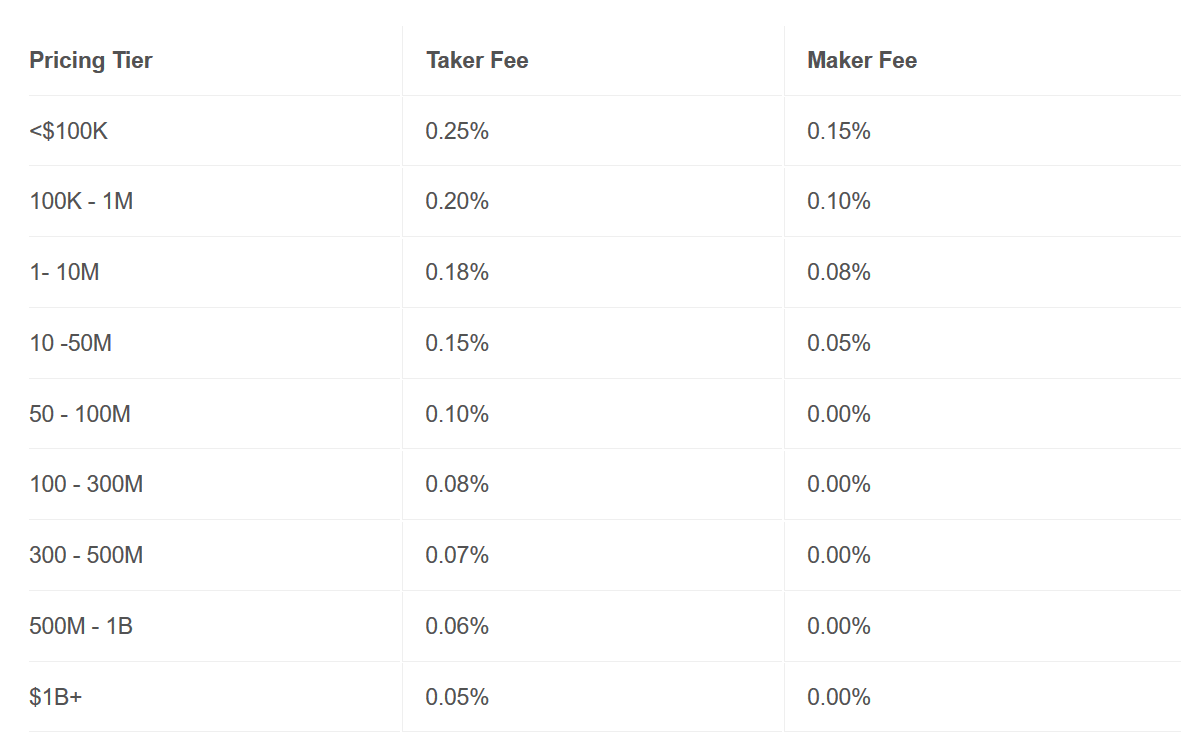

Coinbase Pro New Fee Structure Announced The Cryptonomist

Koinly Vs Zenledger 2022 Is Zenledger Better Than Koinly

The Definitive Guide To Uk Crypto Taxes 2022 Coinledger

Coinbase Pro Accepts Dogecoin Payment In Platform Despite 50 Price Drop In May For Meme Cryptocurrency Tech Times

Coinbase Review 2022 Features Fees Pros Cons Hedgewithcrypto

Cryptoreports Google Workspace Marketplace

How To Do Your Coinbase Pro Taxes Coinledger

Coinbase Pro Review 2022 A Reputable And Safe Crypto Exchange