oklahoma auto sales tax and fees

How much will my tag tax and title cost in Oklahoma. 325 percent of the purchase price.

Oklahoma Vehicle Sales Tax Fees Calculator Find The Best Car Price

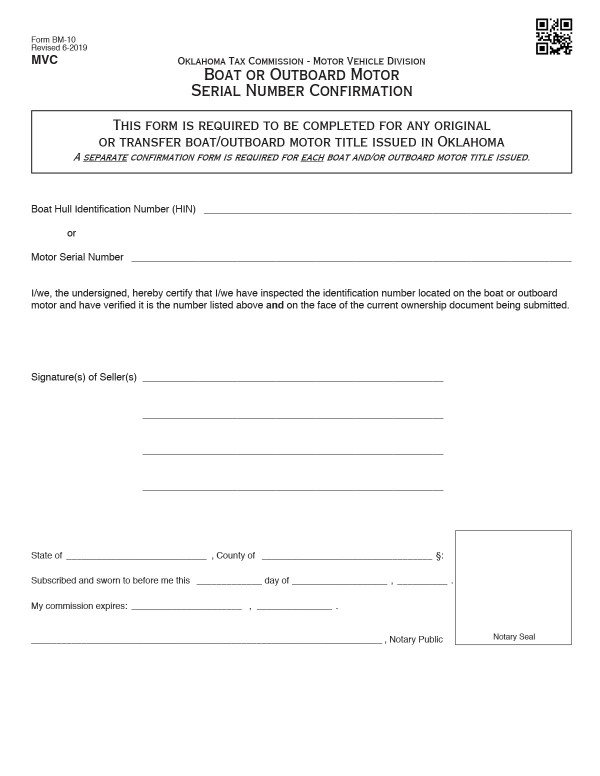

Tag Tax Title Fees Unconventional Vehicles Boats Outboard Motors Rules Policies IRP IFTA 100 percent Disabled Veterans Sales Tax Exemption Motor.

. Typically the tax is determined by. Our free online Oklahoma sales tax calculator calculates exact sales tax by state county city or ZIP code. The excise tax for new cars is 325 and for used cars the tax is 2000 for the first 150000 and 325 on the remainder of the sale price.

We would like to show you a description here but the site wont allow us. In Oklahoma this will always be 325. To calculate the sales tax on your vehicle find the total sales tax fee for the city.

Oklahoma collects a 325 state sales tax rate on the purchase of all vehicles. Oklahoma charges two taxes for the purchase of new motor vehicles. To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county.

The minimum is 725. However it must be noted that the first 1500 dollars spent on the vehicle would not be taxed in the usual way. To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county.

For a used vehicle the excise tax is 20 on the first 1500 and 3 ¼ percent thereafter. Used vehicles are taxed a flat fee of. 125 sales tax and 325 excise tax for a total 45 tax rate.

Multiply the vehicle price before trade-in or incentives by the sales. 325 percent of purchase price. The excise tax is 3 ¼ percent of the value of a new vehicle.

Multiply the vehicle price after trade-ins and incentives by the sales. Ad Get Oklahoma Tax Rate By Zip. The county the vehicle is registered in.

Multiply the vehicle price after trade-ins and incentives. Find your Oklahoma combined. Together these two motor vehicle taxes produced 728 million in 2016 5 percent of all tax revenue in the state.

Check prior accidents and damage. Multiply the vehicle price by the sales. We are a network of over 300 independent state-appointed tag agents that work.

For a small service fee Tax. In Oklahoma this will always be 325. Free Unlimited Searches Try Now.

The base state sales tax rate in Oklahoma is 45. Auto Sales Tax information registration support. Ad New State Sales Tax Registration.

The value of a vehicle is its. Oklahoma also has a vehicle excise tax as follows. To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county.

Local tax rates in Oklahoma range from 0 to 7 making the sales tax range in Oklahoma 45 to 115. Taxpayers pay an excise tax of 325 percent of the price when they buy a new vehicle and a lower tax rate on used vehicles depending on the sales price. There is also an annual registration.

20 on the first 1500 plus 325 percent on the remainder. An example of an item that exempt from Oklahoma is. 20 up to a value of 1500 plus 325 percent on the remainder.

In the state of Oklahoma sales tax is legally required to be collected from all tangible physical products being sold to a consumer. When purchasing a vehicle the tax and tag fees are calculated based on a number of factors including.

63 New Buick Gmc Cars Trucks Suvs For Sale In Oklahoma City Ok

Bills Of Sale In Oklahoma The Templates Facts You Need

What S The Car Sales Tax In Each State Find The Best Car Price

What New Car Fees Should You Pay Edmunds

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Oklahoma City Tax Title License Fees

Car Tax By State Usa Manual Car Sales Tax Calculator

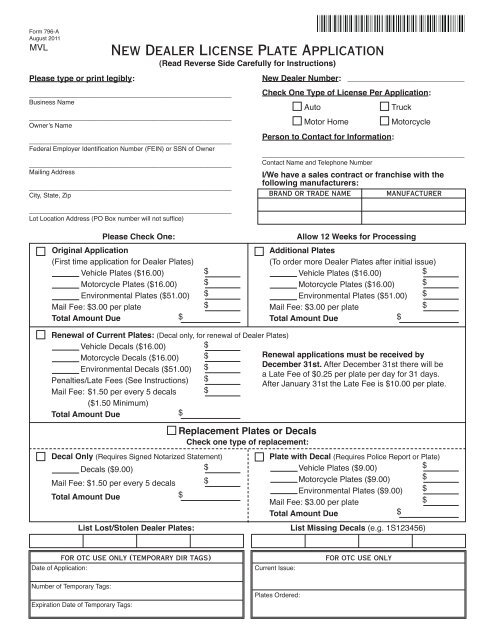

New Dealer License Plate Application Oklahoma Tax Commission

Taxes When Buying A Car Types Of Taxes Payable On A Car Purchase Carbuzz

A Complete Guide On Car Sales Tax By State Shift

Auto Tax Ruling Has Newly Defined Course Of Oklahoma History Capitol Update Oklahoma Policy Institute

Eighth Biennial Report Of The Oklahoma Tax Commission For The Period Beginning July 1 1946 And Ending June 30 1948 Archives Ok Gov Oklahoma Digital Prairie Documents Images And Information

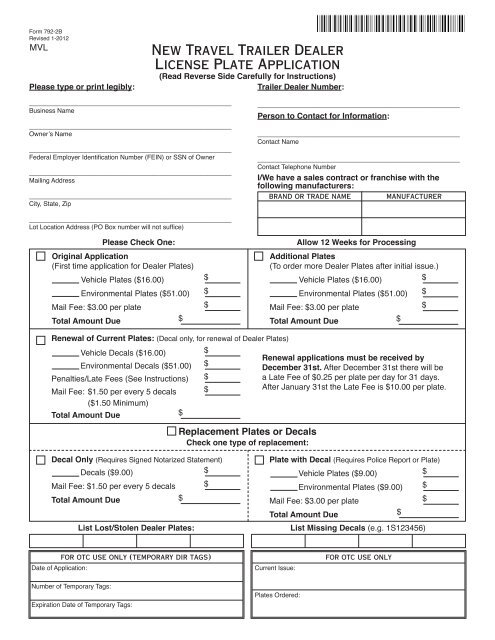

New Travel Trailer Dealer License Plate Application Oklahoma Tax

Oklahoma Supreme Court Upholds Vehicle Sales Tax News Normantranscript Com